Fractional Art Investing Platforms That Democratize a Notoriously Exclusive Market

Summary

Reflection Questions

Journal Prompt

We recently published an article about fractional real estate investing. Now, let’s talk about fractional art investing. No matter the market, fractional ownership offers a more accessible entry point when each individual asset represents an enormous expenditure of cash. By dividing that costly asset into smaller, more affordable shares, investors can expand their portfolios without the risks posed by sole ownership. But fine art? How does that work? Let’s get into it!

Why is Investing in Fine Art Still So Inaccessible?

The high entry costs, specialized knowledge requirements, liquidity challenges, and maintenance responsibilities make art investment inaccessible to many people. These barriers create a market that favors the wealthy and knowledgeable, leaving average investors with limited opportunities to participate in the potential benefits of art investment.

#1 High Entry Costs

Investing in art has traditionally been reserved for the wealthy due to the significant financial barriers to entry. High-quality artworks by renowned artists often come with price tags in the hundreds of thousands or even millions of dollars. This substantial capital requirement makes it difficult for average investors to participate in the art market, limiting access to a select few who have the financial means to acquire and maintain such valuable pieces.

#2 Limited Market Knowledge

The art market is complex and requires extensive knowledge and expertise to navigate successfully. Understanding the nuances of art valuation, market trends, provenance, and the reputations of artists is crucial for making informed investment decisions. Many potential investors lack the necessary background or resources to conduct thorough due diligence, making it challenging for them to enter the market with confidence. This knowledge gap further restricts access to art investment opportunities.

#3 Liquidity and Transaction Costs

Art investment also poses challenges related to liquidity and transaction costs. Unlike stocks or bonds, artworks are not easily divisible and cannot be sold quickly without potentially incurring significant losses. The process of selling art can be lengthy and involves high transaction costs, including auction house fees, insurance, and transportation. These factors make art a less liquid and more cumbersome investment option, deterring those who require more flexible investment vehicles.

#4 Storage and Maintenance

Owning valuable art comes with additional responsibilities, including storage, insurance, and maintenance. Proper care is essential to preserve the condition and value of the artwork, which can entail significant ongoing expenses. These logistical and financial burdens can be prohibitive for many potential investors, further contributing to the inaccessibility of art investment.

How Does Fractional Ownership Remove Barriers to Fine Art Investment?

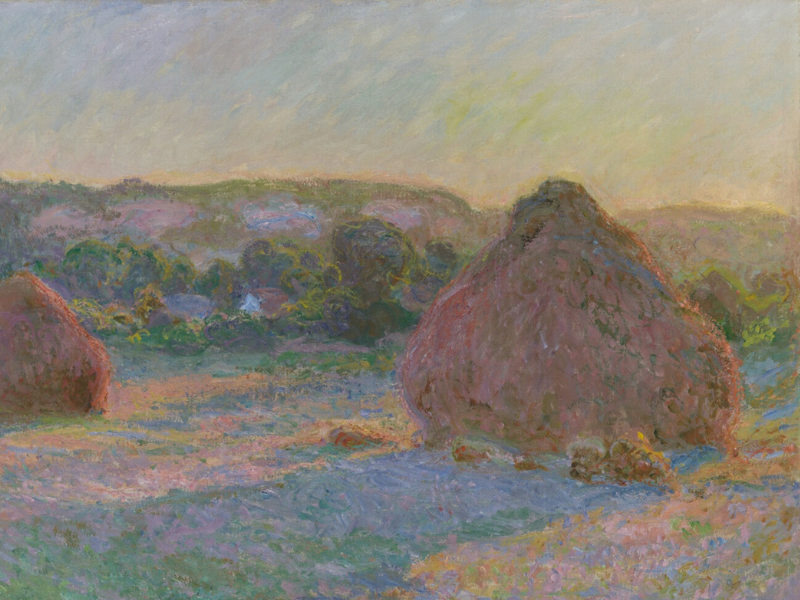

Traditionally, investing in fine art has been reserved for the wealthy due to the significant capital required to purchase entire pieces. Fractional investing democratizes this process by dividing the ownership of a single artwork into smaller, more affordable shares. This enables a broader range of investors to participate in the art market and benefit from potential appreciation and prestige associated with owning valuable art.

Dissecting the Mechanics of Fractional Art Investing

The process begins with an investment platform or company that identifies and acquires high-quality artworks with strong investment potential. These platforms conduct thorough due diligence—assessing factors like the artist’s reputation, provenance, market trends, and historical performance. Once an artwork is acquired, it is divided into fractional shares, which are then offered to investors.

Fuel your creative fire & be a part of a supportive community that values how you love to live.

subscribe to our newsletter

*please check your Spam folder for the latest DesignDash Magazine issue immediately after subscription

Platforms like Masterworks facilitate this process. They provide a digital marketplace where investors can purchase shares, review detailed financial analyses, and track the performance of their investments.

Potential Benefits of Fractional Art Ownership

Investors who buy fractional shares gain partial ownership of the artwork. They receive ownership certificates and are entitled to a proportionate share of any profits generated from the sale of the artwork. Fractional ownership allows investors to diversify their portfolios by investing in multiple pieces of art without the need for substantial capital.

Investors benefit from the expertise and management services provided by the platform, which handles logistics, storage, insurance, and sale of the artwork. This hands-off approach simplifies the investment process while ensuring that the artwork is well-maintained and its value maximized.

Fractional Art Investing Platforms to Consider

Masterworks

Masterworks offers shares in blue-chip artworks, focusing on long-term appreciation. This platform democratizes access to high-value art pieces by allowing investors to buy fractional shares, making it accessible with a minimum investment of just $20. By targeting works from established artists, Masterworks provides investors with opportunities for substantial appreciation over time. The platform’s extensive due diligence and expert selection process ensure that only high-quality artworks are available for investment.

Yieldstreet

Yieldstreet provides Art Equity Funds with thematic focuses, such as collections of African American artists from the Harlem Renaissance. This platform caters to more serious investors, requiring a minimum investment of $10,000. Yieldstreet’s approach allows investors to own a share of a diversified portfolio of valuable artworks, benefiting from the expertise of professional curators and fund managers. This structured investment vehicle offers potential for both appreciation and income.

Particle

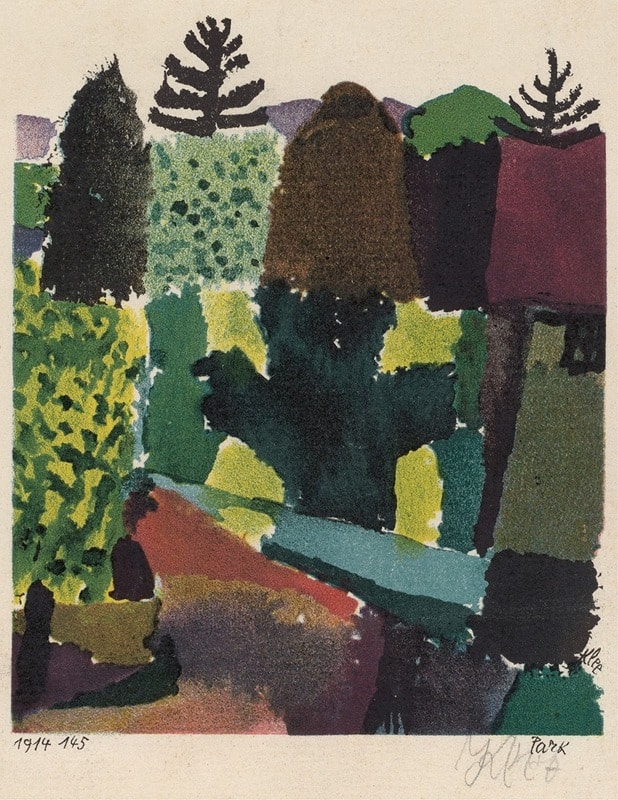

Particle leverages blockchain technology to tokenize artworks, allowing investors to own specific parts of an artwork. With a minimum investment of $1,500, Particle makes it feasible for a wider audience to participate in the art market. Each token represents a fraction of the ownership, providing both security and transparency through blockchain technology. This innovative approach not only democratizes art ownership but also enhances the liquidity and traceability of art investments.

Artemundi

Artemundi focuses on tokenizing high-value artworks, including pieces by Picasso, specifically targeting European investors. With a minimum investment typically around €50, Artemundi offers an accessible entry point into the elite art market. The platform’s use of tokenization allows for fractional ownership, enabling investors to diversify their portfolios with high-value art without needing substantial capital. Artemundi’s model emphasizes security and compliance.

Mintus

Mintus, a UK-based platform, is designed for institutional and accredited investors, focusing on high-quality artworks. The minimum investment is set at $3,000, positioning it as a platform for more serious and experienced investors. Mintus emphasizes the acquisition of artworks with significant appreciation potential, providing detailed market analyses and expert insights. This platform’s approach caters to investors seeking to make substantial investments in the art market.

Konvi

Konvi allows for the co-ownership of luxury assets, including art, with investments starting at €250. Regulated by the Central Bank of Ireland, Konvi provides a secure and transparent platform for fractional ownership. This platform’s broad focus on luxury assets, including art, makes it a versatile option for investors looking to diversify their portfolios. Konvi’s regulatory oversight and low entry point make it accessible to a wide range of investors.

Rally

Rally offers fractional ownership in various collectibles, including art, and facilitates trading on a secondary market. This platform allows investors to buy shares in high-value collectibles with the flexibility of trading these shares later, enhancing liquidity. By democratizing access to the collectibles market, Rally provides a unique opportunity for investors to diversify their portfolios with rare and valuable items. The platform’s secondary market feature ensures that investors have an exit strategy.

Before You Buy: Key Considerations for Beginner Investors in Fractional Art Investing

Understand the Risks and Rewards

Before diving into fractional art investing, beginner investors should thoroughly understand both the potential rewards and the inherent risks. Art markets can be unpredictable, and the value of artwork can fluctuate based on various factors, including trends, artist reputation, and broader economic conditions. While art can appreciate significantly over time, it is also possible to see little to no return, or even a loss. It’s crucial to recognize that art investment should be part of a diversified portfolio rather than a sole investment.

Research the Platform

Not all fractional art investment platforms are created equal. Investors should diligently research the platform they are considering, looking into its reputation, track record, regulatory compliance, and user reviews. Understanding the platform’s fee structure, including management fees, transaction fees, and any other associated costs, is also essential. Ensuring the platform is transparent about these fees will help investors understand the potential impact on their returns.

Evaluate the Artwork

Even with fractional ownership, the quality and potential of the artwork being invested in are critical. Investors should look at the artist’s history, the provenance of the artwork, and its market performance. Many platforms provide detailed analyses and reports on the artworks they offer, which can be a valuable resource. However, it’s also wise to seek independent opinions and do additional research to validate the investment potential.

Understand Liquidity and Exit Strategies

Fractional art investments can be less liquid than traditional financial assets. While some platforms offer secondary markets for trading shares, the ease of selling these shares can vary. Investors should be aware of the platform’s policies on liquidity, minimum holding periods, and the conditions under which they can sell their shares. Understanding these exit strategies is crucial for managing your investment and accessing your capital when needed.

Consider the Investment Horizon

Art is generally considered a long-term investment. Beginner investors should be prepared to hold their shares for several years to potentially see significant returns. The investment horizon can vary depending on the specific artwork and market conditions, so having a clear understanding of the expected time frame is important.

Consult with Experts

Given the complexities of the art market, consulting with financial advisors, art experts, or investment professionals can provide valuable insights and guidance. These experts can help you navigate the market, understand the potential risks and rewards, and make informed decisions aligned with your financial goals.