October’s Almost Here! Small Business Tax Deductions for Design Firms

Summary

This article highlights essential tax deductions for interior design business owners, including expenses like home office space, professional development, and travel. It provides actionable tips to help you organize your finances, take full advantage of available deductions, and reduce your overall tax burden.

Reflection Questions

- How confident do I feel about my current tax preparation process, and where can I improve?

- What specific deductions could I be overlooking that are unique to running an interior design business?

- How can I better track my project-specific expenses throughout the year to maximize my tax savings?

Journal Prompt

Reflect on your current approach to managing your business taxes. What systems do you have in place, and how could streamlining your financial tracking help you feel more in control when tax season arrives? Write down specific goals you want to achieve in the next tax year to reduce stress and maximize deductions.

As an interior design firm owner, if you filed for a tax extension in April, the October deadline is now quickly approaching to submit your 2023 taxes. Extensions give you extra time to file, but not to pay—so it’s important to ensure everything is in order before the cutoff. Running a design business means you’re already managing monthly sales taxes, and on top of that, there’s local business taxes, self-employment taxes, state income, and federal income taxes. Nationwide recommends setting aside at least 30% of taxable income to cover your tax obligations.

From payroll and property taxes to capital gains and income tax, there’s a lot to consider before the October deadline hits. The good news is that interior design business owners have access to numerous tax credits, write-offs, and deductions. Expenses like health insurance premiums and office supplies are often tax-deductible, helping to ease the tax burden. In this article, we’ll break down 30 small business tax deductions you should know about, along with a few valuable tax credits. As always, consult with a tax professional for specific guidance on your firm’s tax situation.

Let’s figure this out so you can get back to designing!

Actionable Tips to Make Sure You File Correctly This Fall

Running an interior design firm comes with its own unique set of tax challenges, but staying organized and informed can make tax season a lot smoother. Whether you’re just starting out or have been in business for years, there are practical steps you can take to ensure your taxes are accurate and you’re getting all the deductions you deserve. Below are five actionable tips tailored specifically for women leading design firms to help you stay on top of your tax obligations and maximize your savings.

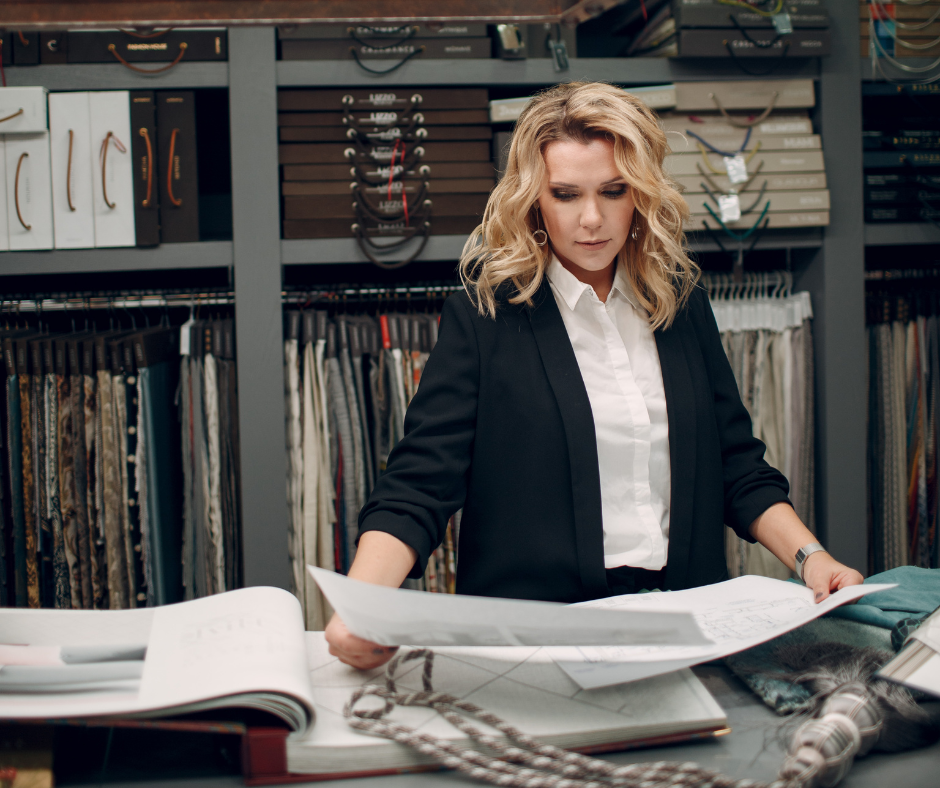

Stay Organized with Project-Specific Records

Keep detailed, organized records for each design project, including receipts for materials, client meetings, travel, and software tools. Using project management software integrated with your accounting system can streamline this, helping you easily track billable expenses and deductions.

Work with a Tax Professional Who Understands Creative Businesses

It’s essential to collaborate with a CPA who specializes in small businesses and has experience with interior design firms. They can help you navigate industry-specific deductions, like expenses for showrooms, trade show fees, or design software subscriptions, ensuring nothing gets overlooked.

Maximize Home Office and Studio Deductions

Many women in design operate from home offices or studios. Ensure you’re taking advantage of deductions for a dedicated work space, whether it’s for your office, sample library, or storage for materials. If you also work remotely or travel for client meetings, there may be additional deductions for those expenses.

Pay Quarterly Estimated Taxes to Avoid a Big Year-End Bill

Women entrepreneurs often wear many hats. To avoid being hit with a large tax bill, break it down by paying estimated quarterly taxes. This will keep you financially steady, help avoid penalties, and give you a clearer sense of cash flow throughout the year.

Deduct Professional Development and Networking Costs

From attending design conferences to joining industry organizations like ASID (American Society of Interior Designers), professional development is crucial for staying competitive. These costs are deductible, as are expenses related to networking events that help grow your business. Make sure you claim them!

What’s the Difference Between Tax Deductions and Tax Credits?

State, federal and local governments all offer a variety of tax deductions, tax credits and other tax breaks to small business owners. A 2020 study conducted by Princeton researchers and published in the Journal of Economic Perspectives examined this at length. The study estimated that local and state governments pay businesses approximately $30 billion each year in tax incentives.

These incentives encourage businesses to relocate — or continue operating — in certain areas of the country — thereby providing jobs and revenue. The federal government also offers tax incentives to small business owners, but their intentions differ somewhat from those of local and state governments.

Tax Deductions for Interior Designers

But what is the difference between tax deductions and tax credits? In her article “10 Commonly Overlooked Small Business Tax Credits” for the US Chamber of Commerce, Emily Heaslip explains. Heaslip writes that tax deductions “reduce how much of your business income is subject to taxes.” Essentially, tax deductions “‘lower your taxable income by the percentage of your highest federal income tax bracket.'” Many typical expenses incurred by interior design business owners are tax-deductible.

Tax Credits for Interior Designers

Tax credits — on the other hand — reduce “the amount of tax owed by giving you a dollar-for-dollar reduction of your liability.” In a recent article for Investopedia, Julia Kagan explains why the federal government offers tax credits to small businesses. Kagan notes that “business tax credits are designed by the government to encourage a particular type of corporate behavior.”

These credits offer companies “a direct reduction in tax liability in return for taking a particular action.” These actions are often related to employee protections, opportunities and benefits. For example, many tax credits are dedicated to things “like worker pensions and employment opportunities for groups facing barriers to employment.”

25+ Small Business Tax Deductions for Interior Designers

The following business expenses might be tax-deductible for your interior design firm. Read along to learn which expenses you can deduct as a small business owner in 2022.

Home Repairs and Maintenance

First on our list of small business tax deductions are home repairs and maintenance. According to Stephen Fishman, J.D. in a recent article for NOLO, “you can deduct all or part of home repair costs.” You can only do this “if you have a business and use a portion of the home as an office for the business.”

In order to qualify for this small business deduction, one must “must have a legitimate business.” They must also “use part of the home exclusively and regularly for the business.” If you do qualify for the deduction, you can claim the entire cost of any repairs made specifically to your home office.

A smaller percentage of repair costs related to other parts of your home could also be tax-deductible. These include repairs to your roof, foundation or insulation. The amount you can deduct is determined by the size of your office compared to the size of your entire house. Fishman provides an example. He writes that “if you use 20% of your home as an office, you may deduct 20% of the cost to repair your HVAC.”

Home Office Deduction

Not every successful interior design business owner works from a stunning downtown studio office. Many work from home. Thankfully, the IRS also recognizes a home office deduction for those business owners. According to this resource from the Internal Revenue Service, “the home office deduction…is available to both homeowners and renters.” It is only available to those who operate a business from their home. In order to qualify for this deduction, your home office must be used exclusively and regularly for business. It must also be “the taxpayer’s principal place of business.”

When calculating their deduction, taxpayers can choose either the simplified or regular method. With the simplified method, taxpayers can claim $5 per square foot up to 300 square feet of designated home office space. The regular method allows taxpayers to calculate “deductions for a home office…based on the percentage of the home devoted to business use.”

Rent On Properties You Don’t Have Equity In

There is also a small business tax deduction for rent you pay on your business property. If you rent an office for your interior design firm, you might be able to deduct those payments. Keep in mind that this only applies to a property in which you own no share.

In his article “Getting Ready to File? Tax Deductions For Home-Based Businesses” for the US Chamber of Commerce, Sean Peek explains. Peek writes that the IRS classifies rent as “any amount you pay for the use of property that you do not own.” According to the IRS, this “deduction is only applicable if you do not and will not receive equity in or title to the property.”

Business Loan Interest

As we noted in our post about inflation, nearly half of all small businesses in the US took out a business loan in 2021. Many business owners took out loans to help their companies weather inflation, cover the growing cost of wages and survive supply chain woes.

Thankfully, business loan interest is a tax-deductible business expense. However, not all loans qualify for this deduction. Meredith Turtis explains in her article “Business Loan Interest Tax Deduction: What Small-Business Owners Need to Know” for NerdWallet. In order to qualify, business owners must borrow “from a ‘real’ business lender” and “actually spend your business loan.”

The former means that you cannot deduct interest on funds loaned to you by a family member or friend. The latter means that you cannot let funds from your lender sit in your bank account accruing interest. If you meet these criteria, you can deduct interest on term loans. You can also deduct interest on business lines of credit, short-term loans and personal loans. Interest on these loans qualifies as long as the funds are used for business purposes.

Mortgage Interest

Business owners who work exclusively from home can also deduct interest paid on their mortgage. This is considered one of many home office expenses.

Marketing and Advertising

While not all marketing and advertising expenses are tax-deductible, many are. In order to qualify, the IRS notes that “advertising and marketing costs must be ordinary and necessary to be tax-deductible.” The IRS defines an “ordinary expense” as “one that is common and accepted in the industry.” It defines a “necessary expense” as “one that is helpful and appropriate for the trade or business.”

According to Steve Milano in a recent article for The Houston Chronicle, deductible marketing expenses include “salaries and wages of marketing staff and contractors.” They also include “the costs of administering surveys, creation of advertising, purchases and commissions and sales promotions.” For some businesses, “public relations efforts, product samples, websites, and direct mail” will also qualify.

Car Mileage and Maintenance

Small business owners can also deduct some of the expenses related to their car’s mileage and maintenance. If they use their car for personal and business purposes, small business owners can only claim a percentage of those expenses.

Other rules also apply. According to H&R Block, “the trip from home to your main business location, such as an office or store, is not deductible.” Trips to and from a client’s house or “other business locations” are deductible business expenses.

Inventory

If your business stocks inventory, you might qualify for yet another business tax deduction. This deduction applies to inventory you produce and inventory you purchase. In her article “20 valuable small-business tax deductions” for Bankrate, Cynthia Widmayer identifies eligible deductions. These include “the cost of raw materials, manufacturing and storage, and labor.”

Rented Equipment

You can also write off rental equipment used in your business operations. In most cases, you can claim a deduction for the entire rental cost. Like marketing costs, however, rental equipment must be deemed “necessary and ordinary” in order to qualify for a deduction.

Office Supplies

From furniture to paper clips, your office supplies are all tax-deductible business expenses — as long as you hold onto the receipts. Business owners can deduct up to 100% of the cost of supplies as long as those supplies were used within the calendar year.

Salaried Wages

As we note in our post “Should I Hire Employees or Independent Contractors When I Grow My Business?,” salaried wages are tax-deductible too! Rosemary Carlson explains in a recent article for The Balance Small Business. Carlson writes that wages are tax-deductible if they “are ordinary and necessary” [and] “are reasonable in amount.” Wages must have been “paid for services actually provided [and] paid for or incurred in the current year.”

Business Debt

In our post “Key Differences Between Good and Bad Debt When Running a Business,” we explain bad debt. We note that the definition of “bad debt” is somewhat loose. Bad business debt is typically defined as high interest debt you owe to a creditor. It can also be defined as debt that others owe you and are unlikely to pay back. In general, bad debt does not advance your business development.

It is certainly not a part of your interior design business plan for the year, but sometimes bad debt is unavoidable. If you tried to get clients to pay what they owe you and the IRS recognizes your attempts, you might be able to deduct bad debt on your tax return.

According to Georgia McIntyre in her article “21 Small-Business Tax Deductions You Need to Know” for NerdWallet, business owners can deduct bad debt. First, McIntyre explains how the IRS defines bad debt. To the IRS, it is “‘a loss from the worthlessness of a debt that was either created or acquired in a trade or business.’” From a business perspective, bad debt includes “credit sales to customers,” “loans to clients, suppliers, distributors and employees” and “business loan guarantees.”

Your Retirement Plan

Employers may take deductions related to contributions they make to their own retirement accounts and those they make to their employees’ accounts. The IRS Fact Sheet “Avoiding Incorrect Self-Employed Retirement Deductions” outlines parameters for these deductions. Head over to their resource for more information.

Your Education Expenses

If you — a small business owner — have decided to pursue additional education in your business’s industry, you can claim these expenses. Tuition, text books and even some travel expenses could be deductible. There is also a tax deduction for any investments you make in your employees’ educational opportunities. Professional development events can also be write-offs, though this might differ between industries.

Business Taxes

Certain business taxes are deductible, but not all qualify. For example, business owners should know that self-employment taxes are not tax-deductible. In a recent article for The Balance Small Business, Jean Murray identifies a few business taxes that are actually deductible. These include “state unemployment insurance contributions,” state income tax, local sales tax, real estate taxes, license taxes, excise taxes, fuel taxes and more. Consult a tax professional before you file or pay taxes to ensure you have not violated any rules set by the IRS.

Employee Gifts, Benefits and Bonuses

In her article “20 valuable small-business tax deductions” for Bankrate, Cynthia Widmayer writes that employee gifts, benefits and bonuses are all tax-deductible expenses. Benefits you provide employees with — such as “health insurance, retirement plans, or education assistance”— can all be deducted your income tax burden.

Software and Equipment

Next on our list of small business tax deductions is software and equipment you have purchased for your business. The cost of antivirus software, accounting software, computers and other electronics that your business actually uses can all be deducted on your tax return.

Depreciation

Depreciation is one of many home office expenses that business owners can deduct on their tax return. Business owners can only deduct depreciation on the part of their home they use exclusively and regularly as their primary office.

Business Insurance

Whether you have general liability insurance or professional liability insurance, you can deduct premiums paid throughout the year. As long as this type of business expense is considered ordinary and necessary for your industry, the IRS should allow a deduction.

Qualified Business Income or Pass-Through Deduction

In 2017, the Tax Cuts and Jobs Act changed how business owners can claim the pass-through deduction on their tax returns. Also called the qualified business income deduction, the pass-through deduction allows small business owners to up to 20% of their business income.

According to Andrea Coombes, Tina Orem and Sabrina Parys in an article for NerdWallet, there is an income cap for the QBI deduction. They note that the “total taxable income in 2022 must be under…$170,050 for single filers and $340,100 for joint filers.”

Travel Expenses

We noted above that your car’s mileage and maintenance are both deductible — as long as the car is used exclusively for business. If used partially for business, you can only deduct a portion of the actual expenses. Business owners can also deduct other travel expenses like flights, train tickets and hotel accommodations. Any time you travel to conduct business — whether a full business trip or a short drive to a client’s house — you should be able to deduct related expenses.

Professional Services

Did you hire out any accounting services last year? What about a tax professional, lawyer, small business coaching service or other professional outside of your business? If so, you can consider most professional fees paid by your business tax write-offs.

Security System

Above, we noted that internet expenses — like the software used to protect your work computer — are tax-deductible. Money spent on real-world security systems is also tax-deductible. As long as you can prove that the security system was necessary for your business, you should be able to deduct related costs.

Your Personal Health Insurance and Your Family’s Health Insurance

According to Cynthia Widmayer in her article “20 valuable small-business tax deductions” for Bankrate, “any insurance policy held by the small-business owner is tax-deductible.” This means that “health insurance, property insurance, business continuation insurance, liability coverage insurance, auto insurance, [and] malpractice insurance” are all deductible. Widmayer notes that “employee life insurance, business interruption insurance and compensation costs” are also deductible.

Capital Expenses

Certain expenses are associated solely with starting or expanding a business. These are called “capital expenses,” and most are tax-deductible. In his article “The Top Tax Deductions for Your Small Business” for NOLO, Stephen Fishman, J.D. explains. Fishman writes that “you may deduct $5,000 the first year you’re in business.” You can deduct the rest of your capital expenses “in equal amounts over the next 15 years.”

Charitable Contributions

Small business owners can also deduct charitable contributions. Writing for Business News Daily in his article “Small Business Guide to Charitable Giving and Tax Deductions,” Bennett Conlin explains. Charitable contributions come with a welcome tax deduction. Conlin writes that “cash…gifts of property or equipment [and] travel expenses accrued when helping a charitable organization” are all deductible.

However, Conlin reminds us that “‘what distinguishes small business from large-scale corporations is the connection with the community.'” Small business owners should donate to charity because of their commitment to the local community and other worthy causes. They should not donate solely for the tax deduction.

Tax Credits for Small Business Owners

Below are a few tax credits available to small business owners. The following list only contains federal tax credits, but many state and local governments offer their own incentives. For more information about small business tax credits, consult this resource from the Small Business Administration.

Paid Family and Medical Leave Tax Credit

Increasing Research Activities Tax Credit

General Business Tax Credits

Small Employer Health Insurance Premium Tax Credit

Small Employer Pension Plan Startup Cost Tax Credit

Credit for Employer-Provided Childcare Facilities and Services

Disabled Access Credit

Work Opportunity Credit

These Pandemic-Era Tax Credits Are No Longer Available to Small Businesses

During the COVID-19 pandemic, both state governments and the federal government offered tax credits and other incentives to employers. They offered these incentives to dissuade small businesses and corporations from letting workers go during the pandemic.

These incentives were designed to buoy businesses suffering from lockdowns, supply chain woes and other economic consequences of the pandemic. In 2024, many of these tax credits have since expired or are about to expire in the near future.

Employee Retention Tax Credit

According to the IRS, the Employee Retention Tax Credit was “a refundable tax credit against certain employment taxes.” The credit was “equal to 50% of the qualified wages an eligible employer pays to employees.” Wages paid by employers to employees “after March 12, 2020, and before January 1, 2021” were eligible for this tax credit. This credit has since expired.

Paid Leave Tax Credit

Part of the American Rescue Plan, the Paid Leave Tax Credit has also expired. According to the US Department of the Treasury resource “Small Business Tax Credit Programs,” this credit was extended through September 2021. When in effect, this credit was available to “small and midsize businesses.” Those that offered paid leave to employees who took “leave due to illness, quarantine, or caregiving” could qualify.

Are There Any Tax Incentives for Women-Owned Businesses in the Interior Design Industry?

DesignDash founders Melissa and Laura are also involved with interior design firm Laura U Design Collective, which is a woman-owned, woman-operated business with offices in Houston, Texas and Aspen, Colorado. Given this, Laura and Melissa are always on the look-out for tax incentives designed with female entrepreneurs in mind. While there are no federal tax breaks geared specifically towards women in business, there are quite a few state-level incentives.

Getting your small business certified as a Minority-Owned Business could also “open up some tax incentives…that may not be available to you otherwise.” Minority-Owned Businesses are those composed of at least 51% women and/or POC. In Texas, we have “HUB status.” Hub status is awarded to businesses with at least 51% women, POC or veterans who were disabled during their service. Check with your local and state governments for more information about tax credits, deductions and other incentives. You might be surprised to find out what is available to you and your firm.

Still Stressed About Your October Extension?

Filing your taxes can feel overwhelming, especially when you’re juggling the complexities of running an interior design firm. But remember, you’re not alone, and it’s completely normal to feel nervous about getting everything right. The important thing is that you’re taking action and doing your best to meet the deadline. There are plenty of resources available, from tax professionals to online tools, to guide you through the process. Mistakes happen, but they can often be corrected. Focus on staying organized, taking it one step at a time, and trust that you’ve got the knowledge and support to handle this. You’ve built a successful business—filing your taxes is just another step toward keeping it strong. You’ve got this!

To take the guesswork out of running your interior design firm, we encourage you to consider our upcoming Mastermind Mini. Take a look!

3 Comments

Melissa Grove

Always nice to have an expert in the family!

https://rroyucrt48849.wixsite.com/advertisingmoney

Informative article, exactly what I needed.

Comments are closed.

Jeri

Good things to be aware of…and make me more thankful for my son-in-law the accountant!