Establish and Boost Business Credit as an Interior Design Startup

Summary

Reflection Questions

Journal Prompt

Establishing business credit is an important step to creating and scaling a successful business. An unblemished business credit report offers entrepreneurs access to capital they might not otherwise be qualified to obtain. From small business loans to business credit cards and everything in between, business credit provides a financial foundation for growth. Unfortunately, entrepreneurs do not automatically establish or build business credit just by running their own interior design business. Even if you spend and borrow to support your interior design firm, you might not have business credit. Only certain activities impact your business credit score, and not all creditors report your flawless payment history to business credit bureaus. From registering your business with the Secretary of State to opening trade lines, here’s how to build business credit as an interior design startup.

Answering All Your FAQs About Establishing Business Credit

In the past, you might have borrowed money from family and friends, or taken out a personal loan to support your firm. You might have used your own credit cards to fund operations at your interior design business. Now you’re wondering how to finance your business’ future growth.

Whatever that looks like— opening a new studio location, hiring more employees or adding a service — you will probably need business credit to proceed. But what is business credit, why is it so important, and how do you build it? Let’s start by answering all your frequently asked questions about establishing business credit as an interior design startup.

Why Is It Important to Establish Business Credit as an Interior Design Startup?

Establishing business credit is important because a long, well-maintained business credit history opens the door to all sorts of funding opportunities.

A great business credit score allows small business owners to apply for CRE and small business loans, open credit lines, and so much more. For example, high business credit scores can help business owners get lower rates on their insurance policies.

Plus, it helps you separate your personal expenses from your business expenses — making tax time that much easier. In some cases, you can also protect your personal credit by leaning on business credit.

Increasing your access to business credit ensures you have the capital you need to grow your firm in the ways you want. It allows you to take on debt instead of selling equity in your firm — although prospective investors often check business credit scores too.

Fuel your creative fire & be a part of a supportive community that values how you love to live.

subscribe to our newsletter

*please check your Spam folder for the latest DesignDash Magazine issue immediately after subscription

Marco Carbajo details how many business owners rely on business credit to fund their firms in an article for the U.S. Small Business Administration. According to Carbajo, “75 percent of young firms’ funds come from bank loans and business credit.”

Unfortunately, “20% of small business loans are denied due to business credit” — underscoring the importance of establishing and maintaining a good business credit score. Put simply, “having access to business credit is the lifeline for a business.”

How Long Does It Take to Establish Business Credit?

It’s important to establish business credit early on — even if you plan to grow your interior design startup slowly. After all, you never know when an opportunity for growth might present itself.

According to Ana Gonzalez-Ribeiro, MBA, AFC in an article for Self, “it takes two to three years to build business credit.” You can certainly start building credit now. However, you will need a few years of credit history before a lender will consider you for “a business startup loan.”

What Is the Starting Credit Score for a Business?

The range for business credit scores differs from that of personal credit scores. Most personal credit scores range from a low of 300 to a high of 850 points. On the other hand, most business credit scores range from a low of 0 to a high of 100 points.

Each bureau calculates credit scores differently. The credit score ranges for Dun & Bradstreet PAYDEX and Intelliscore℠ Plus from Experian are 0 to 100 points. However, some credit scores have a wider range.

Credit scores reported by the FICO® LiquidCredit® Small Business Scoring Service℠ range between 0 and 300 points. Equifax’s Business Delinquency Risk Score ranges from 224 to 580 points.

It’s important to monitor all your business credit scores. For example, lenders often look at an applicant’s FICO SBSS score before approving loans and lines of credit. Keep in mind that business credit bureaus are constantly updating their scoring scales.

In an article for Bankrate, Holly D. Johnson outlines which factors impact business credit scores. According to Johnson, business credit scores are determined by “payment history, age of credit history, debt and debt usage, industry risk and company size.”

Someone in the interior design industry might have a different score with similar factors as someone in another industry. The number of trade lines and other accounts impacts your credit score too.

The age of your interior design startup could also play a part in determining your credit score. As your interior design business grows, so will your credit history and — hopefully — your credit score. Your payment history has the most significant impact on your credit score and credit rating, as it indicates reliability.

Will Your Personal Credit Score Impact Your Business Credit Score?

Neither your personal credit score nor your personal credit history should not affect your business credit score. Relying on business credit actually helps insulate your personal credit score.

If your business is structured as a sole proprietorship rather than an LLC or corporation, however, your personal score could suffer. This is because, unlike a limited liability company or a corporation, a sole proprietorship is not legally distinct from its owner.

Conversely, your personal credit score might impact your eligibility for business loans, credit cards and lines of credit. It can also affect the terms of your loan, credit card or line of credit. Lenders often check your business credit score and your personal credit score when considering an application.

Applying for a small business loan, business credit card or business line of credit could hit your personal credit score. In most cases, your first application will trigger a hard inquiry on your personal credit report because your business credit is not yet established.

How Do You Check Your Business Credit Report?

You can check your small business credit score or request a copy of your credit report through any business credit bureau. The three big business credit bureaus are Dun & Bradstreet, Experian and Equifax. Business owners can also sign up for a credit monitoring service to ensure they are notified of any changes — intentional or fraudulent.

What is a Good Business Credit Score?

Lenders look favorably upon business credit scores over 75 points. However, most prefer scores between 80 and 100 as this rating indicates low risk of default.

What Are the Different Types of Business Credit?

According to this Shopify resource, vendor credit, supplier credit, service credit, retail credit and business credit cards are all types of business credit. Keep in mind that loans, credit lines and other types of financing both impact and are impacted by business credit.

Can a Mortgage or Auto Loan Help Boost Your Business Credit Score?

Yes, commercial auto loans and commercial real estate loans can impact your business credit score. If your business structure legally separates you — the owner — from your business, your personal investments probably won’t boost your business credit score.

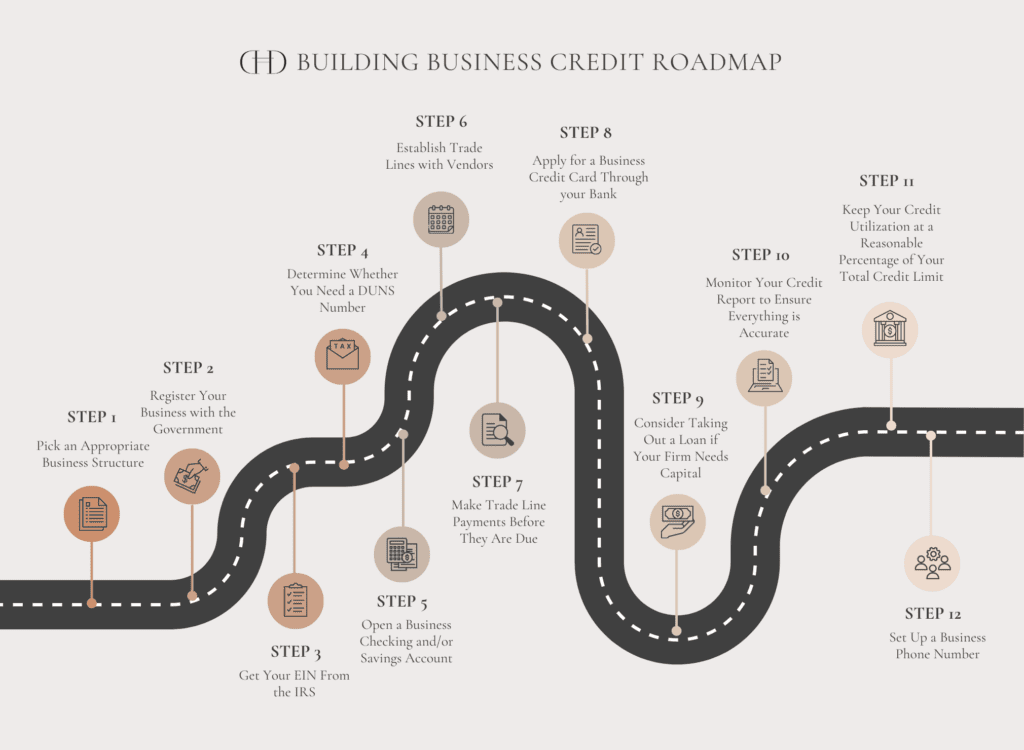

14 Simple Steps to Building Business Credit as an Interior Design Startup

#1 Pick a Business Structure Vendors, Lenders and Clients Recognize

You might be planning to start an interior design business. Or you might have operated as a sole proprietor in the industry for years. Either way, it’s important to pick the right business structure. Many interior design professionals obtain their business license as a sole proprietor, but this structure might actually hinder you from building business credit.

Creditors, lenders, vendors and investors prefer that business owners separate themselves from the business for legal purposes. In fact, many interior designers switch from a sole proprietorship to an LLC or corporation to secure financing.

According to this Accion Opportunity Fund resource, any entity interested in buying into your business or “becoming a partner [will] want a formal structure.” Banks and other financial institutions also prefer business owners to define their legal structure before opening accounts or applying for loans.

The owners of interior design businesses can also protect their personal assets and personal credit scores by structuring as an LLC or corporation. Consider an LLC, S-Corp or other type of corporation when forming an interior design or interior decorating business to establish credit and protect yourself.

#2 Set Up Your Own Business Phone Number

Next, any interior design business coach will recommend that you get your own business phone number. This resource from Experian — a business credit reporting bureau — identifies it as one of four key steps to “begin building business credit.” Business owners should “set up a dedicated business phone line in your business name and make sure it’s listed.”

In addition to a business name and appropriate business structure, a business phone number will help formally separate your business from you personally. Plus, a business phone number will make your business appear more legitimate to new clients.

#3 Register Your Interior Design Business with Your State and Local Governments

Third, you must register your interior design business with appropriate state and local government offices. Most new businesses are registered with the Secretary of State’s Office, but this is not consistent across the country.

For example, new businesses in Hawaii are registered with the State of Hawaii Department of Commerce. In Utah, business owners should contact the Division of Corporations and Commercial Code.

In our Business Structures bundle, we provide an exhaustive list of government office contacts for business owners in each state. The information in this table should help you reach out to the right department when changing your interior design business structure.

#4 Get Your EIN From the IRS

You will also need to obtain an EIN or Employer Identification Number. Establishing business credit in any manner — whether through a checking account, credit card or loan — requires an EIN and SS number. You can apply for an EIN here on the IRS website.

Any time you change the tax structure of your business, you must obtain a new EIN or Employer Identification Number. Changing the name of your business or relocating that business does not usually require you to obtain a new EIN.

#5 Determine Whether You Need a D-U-N-S Number

In addition to your Social Security number and Employer Identification Number, you might also need a DUNS number. According to this resource from Dun & Bradstreet, a DUNS number is “a unique nine-digit identifier for businesses.” This number is associated with that business’s specific “Live Business Identity.”

Only government contractors and businesses registered in Canada or the United States are eligible to claim a DUNS number through this online form. To do so, you will need your business address, phone number, business license and legal name.

You must provide a business address for each and every office space used by your company. In addition, you will need information about its legal and capital structure, history, employees and industry — i.e. the interior design industry.

In the past, DUNS numbers were required of any business that contracted with the US federal government and some state governments. That is no longer the case. However, many private investors, lenders and companies check a business’ credit report through their DUNS number.

#6 Register with Major Business Credit Bureaus

You must register your own interior design business with one, both or all of the major business credit bureaus to establish credit. These include Dun & Bradstreet, Experian and Equifax.

This process actually begins with obtaining a D-U-N-S Number, as your application opens a business credit file for your company. Work with vendors and suppliers who report your payments to Experian, Equifax or Dun & Bradstreet to continue building credit.

#7 Open a Business Bank Account Account

Next, we recommend that you open a business bank account. A business checking account will help you build credit, while a savings account will help you manage cash flow.

A business bank account helps you further separate personal and business finances. This makes you appear more legitimate to lenders, vendors, clients and partners.

Use your business checking account to receive payments related to your interior design services and to cover business-related expenses. If you don’t already have one, here’s how to open a business bank account.

#8 Establish Trade Lines with Vendors Who Report Payments to Business Credit Reporting Agencies

One of the most significant ways to establish business credit is to open trade lines. It’s important to work with a couple vendors or suppliers who relay your payments to business credit reporting agencies.

A spotless history of early or on-time payments will help boost your credit score. This will make you appear more reliable and less risky to other lenders.

#9 Make Trade Line Payments Before They Are Due

Make trade line payments well in advance to ensure those payments are logged before the due date. As Gerri Detweiler notes in an article for Nav, “it may take longer for payments to vendors to be processed.” Vendor payments are not always processed online. Even when they are, your payments might not be “credited the same day.

Making trade line payments early can also help boost your score. According to Louis DeNicola in a Credit Karma article, business owners must “pay vendors early” to achieve the highest Dun & Bradstreet PAYDEX® score.

#10 Apply for a Business Credit Card Through your Bank

You can also apply for a business credit card through the bank at which you opened checking and savings accounts. As long as you avoid carrying a balance on your business credit card, you can earn points and cash back while building credit.

A business credit card can help you separate business and personal finances, earn rewards and pay off major purchases in small chunks. Some offer airline miles, dining credits and other rewards. Still, be wary of the high interest rates and annual fees associated with some business credit cards.

#11 Consider Taking Out a Loan if Your Firm Needs Capital

Taking out a small business loan can also help you build business credit while financing your company’s plans for the future. As we note on the Design Dash blog, not all debt is bad debt. In fact, debt is an important part of many interior design business capital structures.

#12 Monitor Your Business Credit Report to Ensure Everything is Accurate

Our next recommendation is to monitor business credit reports regularly to ensure everything is accurate and current. Checking your credit report provides insight into your credit utilization, accounts and credit history.

There could be errors on your business credit profile, so checking business credit reports ensures you are not penalized for actions you did not take. Monitoring your business credit reports should help you identify any fraudulent activity that might negatively impact your creditworthiness.

#13 Keep Your Credit Utilization at a Reasonable Percentage of Your Total Credit Limit

Keeping your credit utilization rate under 30% is advisable for both business and personal finance. Some sources — like the Small Business Administration — recommend maintaining a credit utilization rate below 50%. Avoid maxing out any business credit cards or over-leveraging business credit lines.

#14 Avoid Any Judgments or Liens

Last on our list of steps to establishing and building business credit is to avoid any liens or judgments that could damage your credit. Pay your taxes on time, make regular payments to lenders of secured debt and try to avoid any legal judgments against your business.

Fuel your creative fire & be a part of a supportive community that values how you love to live.

subscribe to our newsletter

*please check your Spam folder for the latest DesignDash Magazine issue immediately after subscription