Q1 Checklist: Design Firm Tax Prep 2025

Summary

Reflection Questions

Journal Prompt

You might be the firm owner who made all four estimated quarterly payments and kept track of every single receipt. Or you might be the business owner who fell far behind on bookkeeping. No matter your approach, tax season is stressful for most small business owners. In this article, we offer our tips for small businesses as they prepare to file taxes in 2025. After all, it’s NEXT MONTH! From reviewing key dates to checking sales tax remittance rules, follow below for a small business tax prep checklist, roadmap, calendar, and more.

Before You Get Started

Tax season is upon us; it’s March and April is just mere weeks away. To make the most of Q1, let’s take a look at what we can achieve before taxes are due in April. First, we recommend sifting through tax documents from the last couple of years.

After reviewing key dates for the first couple months of 2025, you should determine which types of taxes your business will owe this year.

Types of Taxes You Might Owe

Before moving onto our small business tax checklist, let’s review the types of small business taxes you might owe. Small-business taxes are multipartite. Business owners often owe federal and state income, self-employment, payroll, sales, excise, use and property tax. Some also owe gross receipts tax instead of state income tax. Certain business owners must pay taxes on dividends and interest too.

The types of taxes you owe the IRS will vary based on your business’ legal entity or tax structure. How much you owe will also depend on whether your business is structured as a sole proprietorship, partnership, LLC, corporation, nonprofit or co-op.

Which corporation your business is structured as could impact the type and amount of taxes too. C Corporations, S Corporations and B Corporations are sometimes taxed differently. Consult our post “Choosing the Right Business Structure for Your Creative Firm” for more information.

To start, many self-employed filers pay federal and state income tax and self-employment tax.

Self-Employment Taxes

The self-employment tax includes your Social Security and Medicare taxes. FICA taxes are usually covered in part by an employer but, business owners pay Medicare and SS taxes entirely themselves. For business owners who owe self-employment tax, the current rate is 15.3%.

According to the IRS, that breaks down to “12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).” Sole proprietorships, some partnerships and businesses classed as non-corporate LLCs typically pay self-employment tax. Limited partners are not required to pay self-employment tax.

Employment or Payroll Taxes

Businesses with employees — not just independent contractors — will also owe employment taxes based on what they paid workers over the last year. In an article for SmartAsset, Amelia Josephson details the current rates for FICA taxes. She writes that “the current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee.” On top of that, the “rate for Medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%.”

Payroll taxes add up to 15.3% of the employee’s wages, but employers only pay half of that amount. Employees pay the other 7.65%. Keep in mind that bonuses are taxed differently than regular wages. Most businesses with employees pay payroll taxes throughout the year. Bonuses are typically offered at the end of the year, while payroll taxes are paid throughout the year.

Estimated Quarterly Taxes (Federal and State Income Taxes)

Most business owners are required to pay estimated taxes — due quarterly — based on the previous year’s income. Estimated tax payments are four equal payments due throughout the year — usually in April, June, September and the following January.

Both the IRS and your state’s franchise tax board — unless you live in one of nine states — require business owners to submit these payments. The nine exempt states are Texas, Washington State, Alaska, Tennessee, Florida, South Dakota, Nevada, Wyoming and New Hampshire. Keep in mind that certain income is still taxed in some of the states that do not collect a general income tax. For example, your state might levy taxes on dividends, interest and other forms of taxable income.

While nonprofit organizations are exempt from many paying certain taxes, some are still required to make estimated quarterly payments. According to this resource from Nonprofit Expert, “tax-exempt organizations must make quarterly payments of estimated tax on unrelated business income.”

Income-generating activities that fall outside the scope of a nonprofit’s tax-exempt status are considered “unrelated.” Nonprofits must pay income tax on money earned from these activities. Learn more about unrelated business income tax here.

What if My State Doesn’t Collect Income Tax?

Your state might also require you to make estimated quarterly payments. As noted above, all fifty states do not collect state income tax. However, some collect gross receipts tax in place of state income tax.

According to this resource from tax policy nonprofit The Tax Foundation, “gross receipts tax is a tax applied to a company’s gross sale.” Gross sales are total sales or top-line sales, meaning the entire dollar amount of sales before any “deductions for a firm’s business expenses.”

A gross receipts tax differs from a sales tax in one key way: it applies to “business-to-business transactions in addition to final consumer purchases.” In some cases, the consumer does pay GRT, but the business typically bears this tax burden.

Depending on the services and products you offer, your business might also owe sales tax on top of gross receipts tax. You are responsible for collecting sales tax from clients.

Sales Tax

Anyone who produces or resells a product is responsible for collecting sales tax from their clients and/or customers. This includes interior designers who source everything from raw materials for flooring and cabinetry to finished products like light fixtures and furniture.

Business owners must also collect sales tax on what the government calls “taxable services.” Determining which services are taxable and which are tax-exempt can be incredibly difficult. After all, each state — and even local government — has a different approach to taxing services.

Consult our post “What Your Interior Design Firm Should Know About Sales Tax” for more information. You can also contact your Department of Tax and Fee Administration for help.

Use Tax

A use tax is a special kind of sales tax levied by state governments. This tax applies to raw materials and products bought out of state — often online — that you later sold to a customer. In an article for Investopedia, Rajeev Dhir explains that “use tax is charged on any goods purchased without paying a sales tax.” Use tax is typically collected only “when one would normally be applied in their home state.”

States impose use tax to prevent unfair competition. They hope to avoid out-of-state retailers offering far lower prices on goods because they do not owe the same sales tax in-state retailers do. According to Dhir, “use tax is generally the same rate as the local/state sales tax.”

Excise Tax

Organizations that perform certain types of services and/or sell products might also need to pay excise taxes. This TurboTax post explains an excise tax is a tax imposed by federal, state and/or local governments “on a particular good or service.”

Excise taxes apply to specific items like gasoline, tobacco or alcohol. As such, “each excise tax has its own rate that may be expressed as a flat dollar amount or a percentage.” To pay federal excise taxes, you will need IRS Form 720: Quarterly Federal Excise Tax Return.

Property Tax

You could also owe property tax on commercial buildings owned and used by your company. Jean Murray explains in an article for The Balance Money. Murray writes that “if your business owns real property…it must pay property tax to the local taxing authority.”

If you sold property within the last tax year, you might also owe capital gains taxes. In an article for Investopedia, Chizoba Morah writes that nonprofit organizations are “exempt from paying sales tax and property tax.”

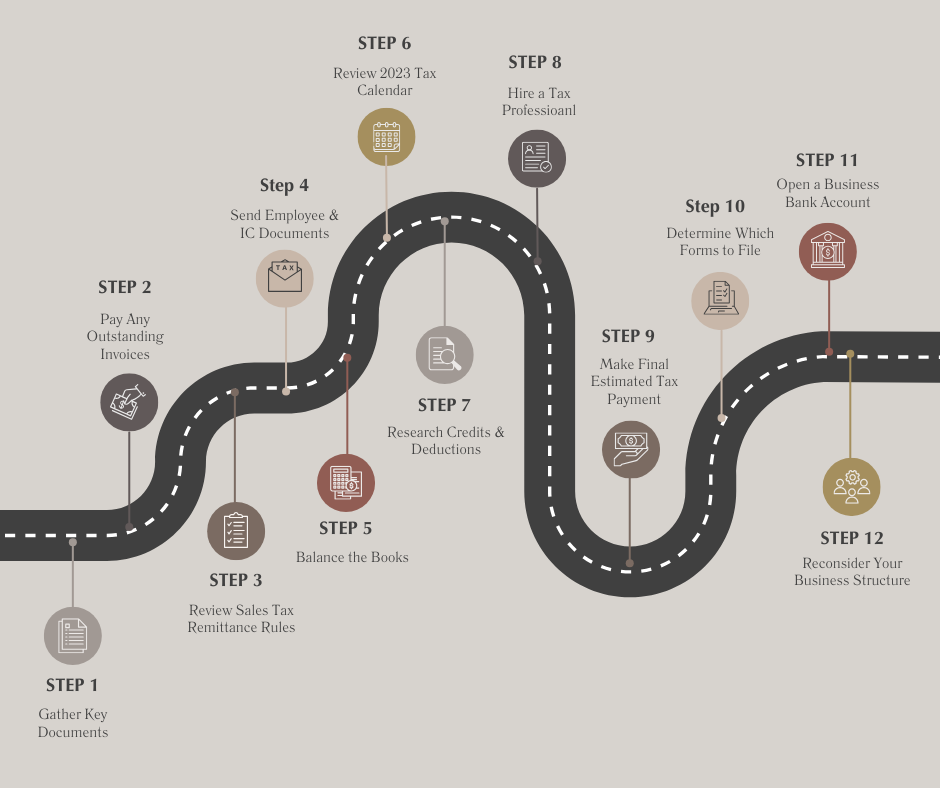

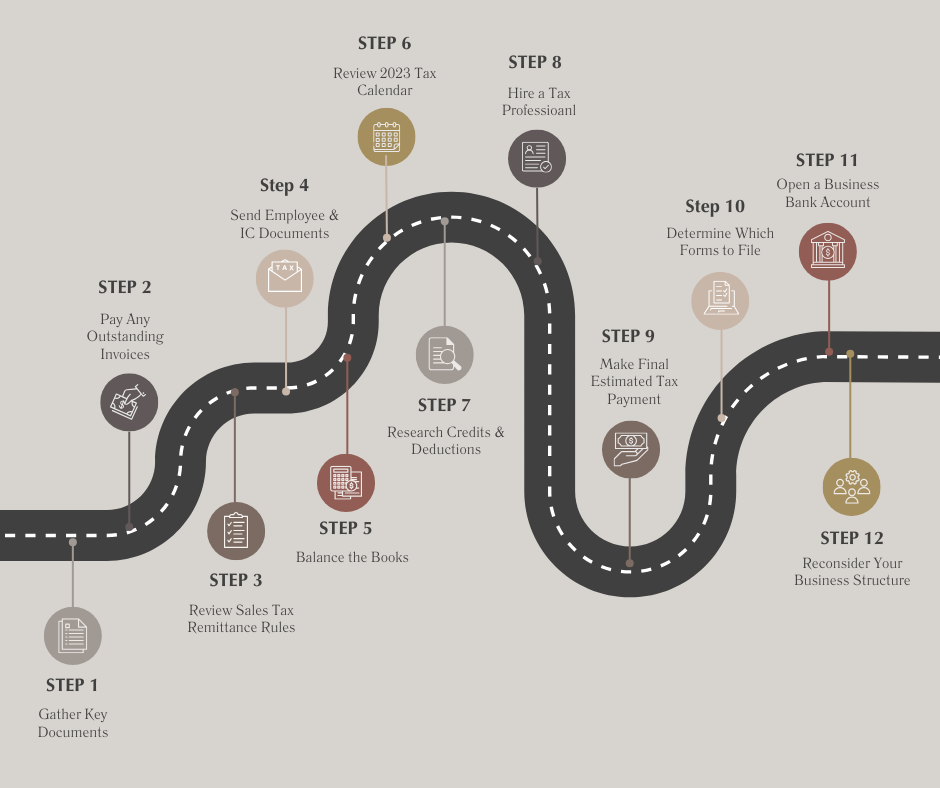

Small Business Tax Preparation Checklist

Now that you know which taxes you might owe, let’s move on to our Small Business Tax Preparation Checklist. Bear in mind that the roadmap described above is a guide. You need not follow the roadmap in any specific order. Just make sure to review the tax calendar, so you meet each IRS, local government and state franchise tax board deadline.

Step 1: Gather Key Documents

The first step on our tax preparation checklist is to gather key documents. You will need documents related to the 2024 tax year as well as relevant documents from prior tax years. Download tax returns from 2021, 2022 and 2023 — plus specific information about any federal and state grants, loans, stimulus checks and assistance.

Have your business license, Employer Identification Number (EIN), IRS pin number and banking information on hand for filing taxes. You might also need a copy of your business’ Operating Agreement or Articles of Organization. Partnerships and Corporations typically provide the IRS with these documents when filing. Round up all documents related to income — including investments, dividends and interest earned. You will also need any and all documents related to your expenses — including payroll.

Collect sales tax, use tax, excise tax, property tax and cost of goods sold documentation. Make sure you have evidence of the local, state and federal taxes you paid throughout the 2024 tax year.

You will need most — if not all — of the above documents to file your federal tax return.

Step 2: Pay Any Outstanding Invoices

Next, you will want to pay any outstanding invoices sent during the 2024 tax year. Around this time, collect on any unpaid invoices you mailed out last year.

If clients do not pay any of the invoices you sent in 2024, keep a record of your attempts to collect. You might be able to report a business-related bad debt on IRS Form 1040, Schedule C, Form 8949 or another appropriate tax form.

Step 3: Review Sales Tax, Excise Tax and Use Tax Remittance Rules

Third, make sure you review sales tax, excise tax and use tax remittance rules in your state and municipality. Review federal remittance rules too, so you know exactly when to pay each bill.

Some state and local governments require remittance quarterly, while others collect at the end of the fiscal year. Bear in mind that your business’ assigned filing period might have changed over the last year. Check in with the appropriate department before filing.

Step 4: Send Necessary Tax Documents to Employees and Independent Contractors

Fourth on our small business tax prep checklist is to make sure workers have everything they need. Before January ends, you will need to send out all necessary tax documents to employees and independent contractors. Unless you do so, employees and independent contractors will be unable to file their own tax returns. These documents include W-2, W-9 and 1099 forms. All forms must be mailed by 31 January 2025.

Step 5: Balance the Books and Reconcile Bank Accounts

Many small business owners handle their own bookkeeping with the help of small business accounting software. Others hire a CPA or other accounting professional.

Either way, review your business’ financial statements — including balance sheets, statements of retained earnings, income statements and cash flow statements. Make sure all transactions are properly categorized, check for errors and make adjusting entries to close out accounts receivable/payable.

Step 6: Review the 2025 Tax Calendar

The sixth step in our business tax preparation checklist is to review the 2025 tax calendar. Though your federal income tax return will be due in either March or April, there are other key dates to keep in mind. For example, the final estimated payment of 2024 was due 15 January.

Plus, this resource from TaxAct notes that “there are different filing deadlines to be aware of depending on what type of business you have.” If your business is structured as a pass-through entity, you must have filed federal tax returns by 15 March 2025. LLCs structured as S-Corps, for example, must have filed by then.

Fuel your creative fire & be a part of a supportive community that values how you love to live.

subscribe to our newsletter

*please check your Spam folder for the latest DesignDash Magazine issue immediately after subscription

Step 7: Research Credits and Deductions for Small Business Owners

Seventh on our tax planning roadmap is to research tax credits and tax deductions designed to help small business owners reduce their tax bill. State, federal and local governments all offer a variety of tax deductions, tax credits and other tax breaks to small business owners.

A recent study estimated that local and state governments pay businesses a whopping $30 billion each year in tax incentives! Don’t file without sifting through all the deductions and credits that might apply to your business.

There are deductions for everything from rental income and business loan interest to car mileage and employee bonuses. Tax credits include the Work Opportunity Credit, Paid Family Leave Credit and the Small Employer Health Insurance Premium Tax Credit. In this recent post, we list dozens of small business tax deductions every entrepreneur should know.

Step 8: Hire a Tax Professional

To streamline the tax prep and filing process, consider hiring a tax professional. You might also choose to use an online tax preparation service or buy small business tax software.

Step 9: Make Your Final Estimated Tax Payment

The final estimated tax payment is usually due on 15 January of the following year. However, if the 15th falls on a weekend, the final estimated tax payments are due the following Monday.

Step 10: Determine Which Forms to File

Next, you must determine which forms to file. Sole Proprietors file Form 1040, 1040-ES & 1040 Schedule SE, Schedule C and/or Schedule 1. Partnerships file Form 1065 and Schedule K-1. Each S Corporation will file Form 1120S or 1120S Schedule K-1, while C-Corps file Form 1120 and Possibly 8832. Employers must file Forms 1099-NEC, 1096, W-2, W-9, 1095c, 940 and/or 941 with the IRS. If you need an extension as a Sole Proprietor, file Form 4868 by 18 April. Partnerships or Corporations that need an extension should file Form 7004 by 15 April.

You might also need to file Form 1099-K this year — even if you have never needed to file it in the past. In her article “Business owners have an IRS payment coming due well before April federal income tax deadline” for CNBC, Cheryl Winokur Munk explains. Munk notes many business owners must file “a 1099-K tax form this year related to sales through third-party processors such as Venmo or PayPal.”

In years prior, businesses making more than $20k in third-party-processed payments had to file a 1099-K form. This year, businesses receiving “$600 or more” through Venmo, PayPal or a similar processing service must file that form.

Update: As of January 2023, the IRS had delayed the $600 minimum reporting requirement for Form 1099-K. According to the National Tax Advocate blog, “$20,000 and 200 transactions thresholds remain in place.” We will alert readers to any further changes as the IRS announces them.

Step 11: Open a Business Bank Account

These final two steps are optional, but could make your 2025 tax planning period much easier than last year’s. First, we recommend opening a business checking or savings account to keep business and personal finances separate for the 2025 tax year.

Step 12: Reconsider Your Business Structure for Next Year

Finally, you might reconsider your business structure. There are many reasons why business owners opt for a new legal structure. One common reason is to lower their federal income tax bill.

Your business structure not only determines how protected you are from debt, lawsuits and other liabilities. It also determines how much you pay in taxes, how you file your taxes and how much you pay in fees.

If your business income is currently taxed as your personal income, you could save by incorporating. For help choosing the right business structure for your firm, read this post on our blog.

Still Stressed About Tax Season?

You need not rush through the tax prep process, but you must be aware of rules, deadlines and fees. It’s a common misconception that businesses can file and pay taxes in October rather than April if they cannot afford their entire bill. While you can choose to file paperwork in October, you must pay in April. If you think you might need an extension, ask the IRS before 15 April by submitting all appropriate tax forms.